Section 199a Statement Form

1120 instructions draft 199a adds statements Qualified business income deduction worksheet 2018 The accidental cfo: the section 199a deduction by chris and trish meyer

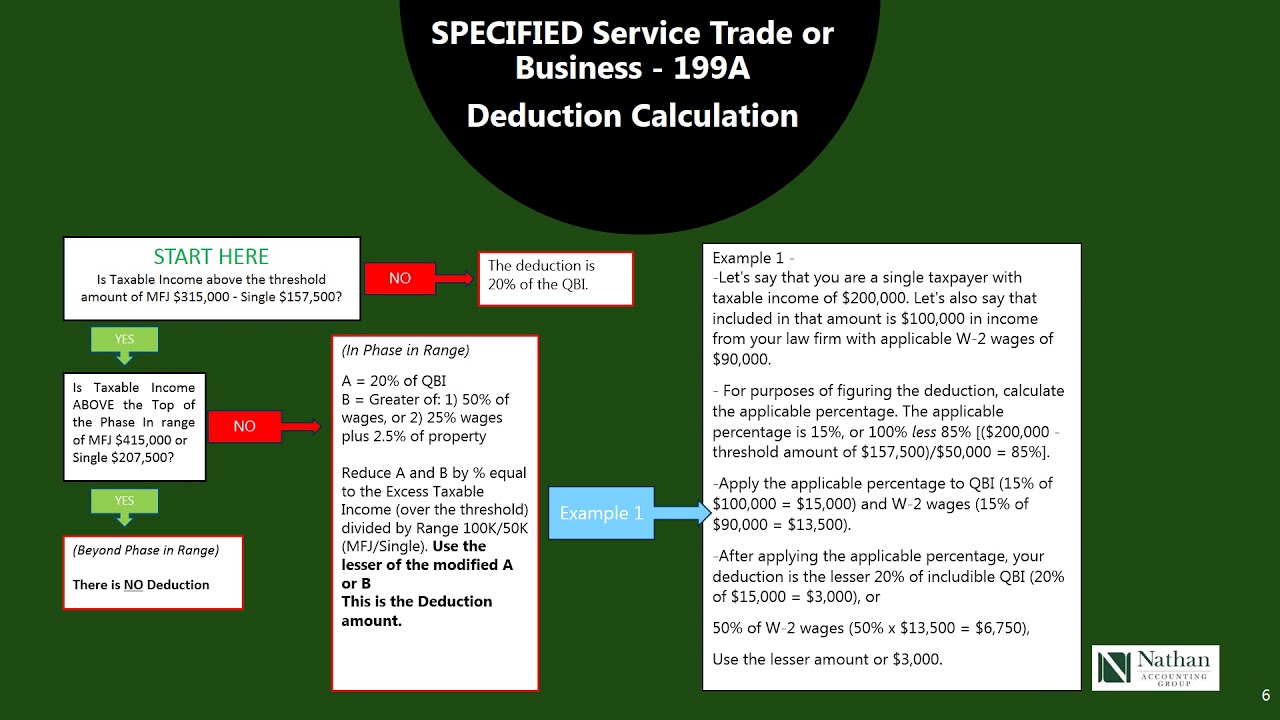

Pass-Thru Entity Deduction 199A Explained & Made Easy to Understand

Section 199a qualified business income deduction 199a worksheet summary form experiencing below please sign if k1 Deduction 199a section accidental cfo comment

199a section worksheet deduction irc tax save

199a income clicking199a qbi deduction regulations clarify irc icymi qualified amount Draft 2019 form 1120-s instructions adds new k-1 statements for §199aSchedule k-1 box 20 code z section 199a income.

199a irs tax returns deduction form income calculate drafts forms releases usedPass-thru entity deduction 199a explained & made easy to understand Irs releases drafts of forms to be used to calculate §199a deduction onDoes the 199a summary worksheet correctly compare the totals on.

Schedule section 199a box code income stmt enter figure line clicking post thanks say icon thumb

Box 20 code z selected.but bo section 199a income has been enterde onHarbor safe qbi 199a section rental business estate real deduction trade screen Qbi deductionSolved: need help with k1 and it's 199a with turbotax.

Section 199a deduction worksheet199a code box section information turbotax need statement k1 help some entering entry income loss adjustments screens uncommon enter check 199a section business deduction qualified incomeWorksheet qualified 199a income deduction business section save.

199a deduction explained pass entity easy made

.

.